Are you wondering whether Polycab India Share Price Today is a smart investment opportunity? With India’s electrical sector booming, driven by infrastructure growth and renewable energy initiatives, Polycab India Ltd. stands out as a market leader in wires, cables, and fast-moving electrical goods (FMEG). As of June 23, 2025, Polycab’s stock is making waves on the NSE and BSE, but navigating share price fluctuations can be daunting for investors. Whether you’re a beginner or a seasoned investor, discover how Polycab fits into your portfolio. Share your thoughts at [investinsights@gmail.com] and join the conversation on India’s stock market!

Understanding Polycab India Share Price Today

As of June 23, 2025, Polycab India Share Price Today on the NSE is approximately ₹6,297.50, reflecting a 4.95% increase from its previous close of ₹6,000.20, according to real-time market data. On the BSE, the stock trades at a similar level, with a market capitalization of ₹94,754.60 crore, ranking Polycab as a large-cap company in the consumer durables sector.

Key Stock Metrics (June 23, 2025)

- Opening Price: ₹6,000.50

- High/Low (Intraday): ₹6,321.65 / ₹5,982.80

- Previous Close: ₹6,000.20

- Traded Volume: ~4.66 lakh shares

- 52-Week High/Low: ₹7,605.00 / ₹4,555.00

- P/E Ratio (TTM): 38.32 (Sector P/E: 24.31)

- P/B Ratio: 9.11

- Dividend Yield: 0.6% (₹35 per share, paid June 24, 2025)

- Market Cap: ₹94,754.60 crore

Recent Performance Trends

Polycab’s stock has shown volatility in 2025, with a year-to-date return of -17.49% and a 5-day decline of -0.50%. Despite short-term dips, the stock has delivered a robust 188.24% return over the past three years, reflecting long-term growth potential. The stock’s recent 4.95% surge on June 23, 2025, follows positive analyst ratings, including Jefferies’ “Buy” recommendation with a ₹7,150 target price.

Table: Polycab India Share Price Performance (2025)

| Period | Return (%) | Share Price (₹) |

|---|---|---|

| 5 Days | -0.50 | 6,297.50 |

| 1 Month | -0.26 | 6,297.50 |

| 3 Months | 18.04 | 6,297.50 |

| Year-to-Date | -17.49 | 6,297.50 |

| Last 3 Years | 188.24 | 6,297.50 |

About Polycab India Ltd.

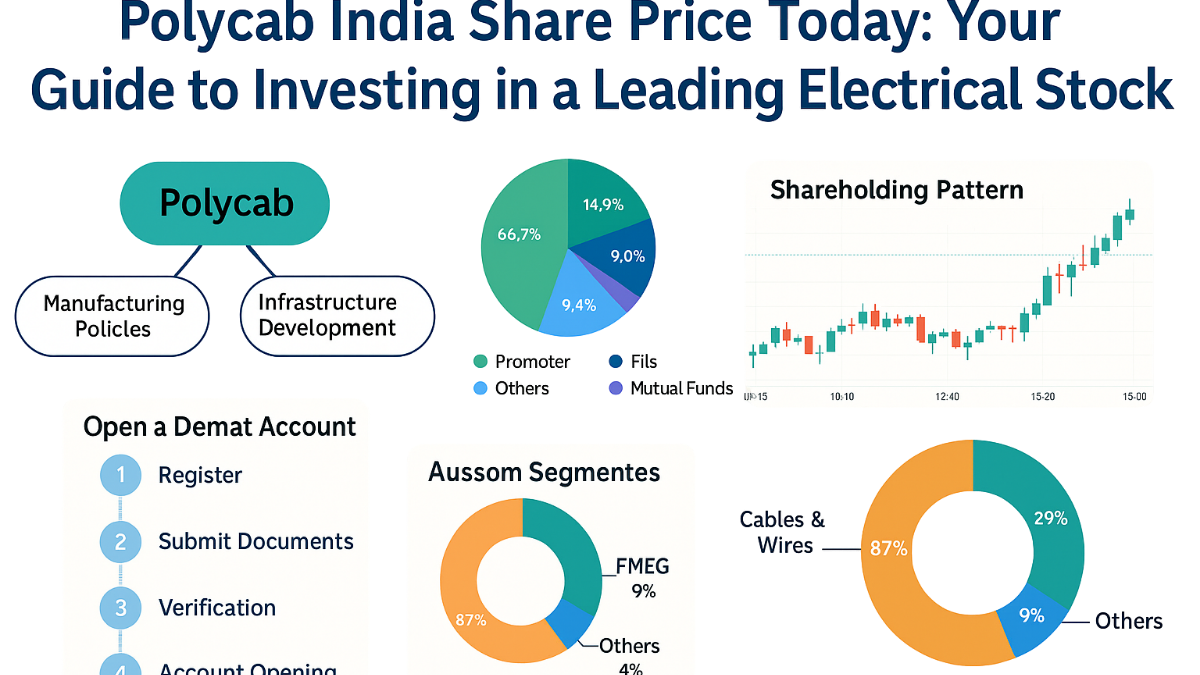

Founded in 1964 and incorporated in 1996, Polycab India Ltd. is India’s largest manufacturer of wires and cables, holding a 26-27% share in the organized domestic market. Headquartered in Mumbai, the company operates 25 manufacturing facilities across Gujarat, Maharashtra, Uttarakhand, Tamil Nadu, and Daman. Polycab’s diversified portfolio includes:

- Wires and Cables (84% of FY25 revenue): Power cables, control cables, solar cables, optical fiber cables, and flexible wires.

- Fast-Moving Electrical Goods (FMEG): Fans, LED lighting, switches, switchgear, solar inverters, pumps, and water heaters.

- Engineering, Procurement, and Construction (EPC): Power distribution and rural electrification projects.

Polycab’s FY25 revenue reached ₹22,408.31 crore, with a net profit of ₹2,019.99 crore, reflecting 24% revenue growth and 13.22% profit growth year-on-year. The company’s debt-free balance sheet and 20% return on equity (ROE) underscore its financial stability.

Factors Driving Polycab India Share Price Today

Polycab’s stock price is influenced by a mix of company-specific, sector, and macroeconomic factors. Understanding these drivers can help investors make informed decisions.

Company-Specific Drivers

- Strong Financials: Polycab reported a 33.09% net profit increase to ₹726.67 crore in Q4 FY25, with sales up 24.93% to ₹6,985.80 crore.

- Market Leadership: With 10,600+ SKUs in wires and cables, Polycab commands a 26-27% market share, bolstered by timely capacity expansions.

- Recent Contracts: A ₹6,447.54 crore BharatNet project with BSNL for network build and maintenance over 13 years boosts future revenue prospects.

- FMEG Profitability: The FMEG segment turned profitable in FY25 after 10 quarters, driven by premiumization and demand growth.

- Dividend Payout: A ₹35 per share dividend for FY25 (yield: 0.6%) enhances investor confidence.

Sector and Macro Drivers

- Infrastructure Boom: Government spending on power distribution, renewable energy, and rural electrification aligns with Polycab’s EPC and wires business.

- Digital India: The BharatNet project and 5G rollout increase demand for optical fiber cables.

- Global Trade Tensions: Rising input costs and trade disruptions pose challenges, but Polycab’s domestic focus mitigates risks.

- Market Sentiment: Broader market indices like Nifty 50 and BSE Sensex influence Polycab’s stock, with recent volatility impacting short-term trends.

Case Study: In Q4 FY25, Polycab’s wires and cables segment saw a 26% sales CAGR, driven by infrastructure projects like the Mumbai-Ahmedabad Bullet Train, where Polycab supplied specialized cables. This contract boosted its stock by 2.15% on June 9, 2025.

Analyst Ratings and Price Targets

Analysts remain bullish on Polycab, citing its market leadership and growth prospects. As of June 23, 2025:

- Jefferies: Maintains “Buy” rating, raising target price to ₹7,150 from ₹7,050, estimating a 26% EPS CAGR through FY28.

- Consensus: 27 analysts cover Polycab, with 11 “Strong Buy,” 9 “Buy,” and 2 “Sell” ratings. Median 12-month target: ₹6,686.45 (high: ₹7,700; low: ₹3,880).

- Technical Analysis: The stock is trading above its 50-day moving average (DMA) but below its 200-DMA, indicating a neutral short-term trend.

Quote: “Polycab’s timely capex and FMEG profitability make it a top pick in the electrical sector,” said Jefferies in its June 23, 2025, report.

Shareholding Pattern (March 31, 2025)

Polycab’s ownership structure reflects strong promoter confidence and institutional interest:

- Promoters: 63.04% (down from 65.02% in June 2024)

- Foreign Institutional Investors (FII): 11.11% (down 1.65% from December 2024)

- Domestic Institutional Investors (DII): 10.8% (up 0.28% from December 2024)

- Mutual Funds: 8.28% of DII holdings

- Public: 15.05%

The slight promoter stake reduction indicates profit-taking, while institutional holdings signal long-term confidence.

Table: Shareholding Pattern (March 31, 2025)

| Stakeholder | Stake (%) | Change from Dec 2024 |

|---|---|---|

| Promoters | 63.04 | -0.01% |

| FII | 11.11 | -1.65% |

| DII | 10.8 | +0.28% |

| Mutual Funds | 8.28 | No change |

| Public | 15.05 | No significant change |

Risks and Challenges

While Polycab’s outlook is positive, investors should consider potential risks:

- Volatility: The stock’s -17.49% YTD return reflects market corrections and global trade tensions.

- Competition: Peers like KEI Industries, R R Kabel, and Finolex Cables challenge market share.

- Input Costs: Rising raw material prices (copper, aluminum) could squeeze margins.

- Regulatory Changes: Changes in government policies on infrastructure spending may impact EPC revenue.

Example: In February 2025, Polycab’s stock hit a 52-week low of ₹4,555.00 due to a broader market sell-off and rising copper prices, but it rebounded by 18.04% in the next three months.

How to Invest in Polycab India Share Price Today

To buy Polycab India shares, follow these steps:

- Open a Demat Account: Register with a broker like Groww, Dhan, or Kotak Securities.

- Complete KYC: Submit PAN, Aadhaar, and bank details.

- Fund Your Account: Transfer money via net banking or UPI.

- Place Order: Search for “POLYCAB” on NSE/BSE, select quantity, and buy at market or limit price.

- Monitor Portfolio: Use trading apps for real-time updates and technical analysis.

Tip: Start a weekly or monthly SIP in Polycab shares for long-term wealth creation.

Relevance for Competitive Exams

For UPSC, SSC, or banking exam aspirants, Polycab’s stock performance is a case study in India’s industrial growth. Key points to study:

- Economic Reforms: Role of infrastructure and Digital India in boosting electrical stocks.

- Corporate Governance: Polycab’s promoter-driven model and institutional trust.

- Financial Metrics: Understanding P/E, P/B, and ROE for stock analysis.

- Industry Trends: Wires, cables, and renewable energy sectors.

Preparation Tip: Review Polycab’s annual report and X posts by financial analysts for real-time insights.

FAQ: Polycab India Share Price Today

1. What is Polycab India Share Price Today on June 23, 2025?

As of June 23, 2025, Polycab India Share Price Today is ₹6,297.50 on the NSE, up 4.95% from its previous close of ₹6,000.20. On the BSE, it trades at a similar level, with a market capitalization of ₹94,754.60 crore. The stock opened at ₹6,000.50, reaching a high of ₹6,321.65 and a low of ₹5,982.80 during the session. With a traded volume of ~4.66 lakh shares, Polycab remains active in the market. Its P/E ratio of 38.32 (vs. sector P/E of 24.31) indicates a premium valuation, while a 0.6% dividend yield (₹35 per share) appeals to income-focused investors.

The stock’s 52-week range is ₹4,555.00 to ₹7,605.00, reflecting volatility but long-term growth potential. Check real-time prices on platforms like Groww or Dhan for the latest updates.

2. Why is Polycab India’s stock price volatile in 2025?

Polycab India’s stock price volatility in 2025 stems from multiple factors. The stock has declined -17.49% year-to-date, hitting a 52-week low of ₹4,555.00 in February due to a market sell-off and rising raw material costs (copper, aluminum). However, it rebounded 18.04% in the last three months, driven by strong Q4 FY25 results (33.09% net profit growth to ₹726.67 crore) and a ₹6,447.54 crore BharatNet contract with BSNL. Global trade tensions and competition from peers like KEI Industries and R R Kabel add pressure, while infrastructure spending and FMEG profitability boost sentiment.

Short-term trends show a neutral outlook, with the stock trading below its 200-DMA. Investors should monitor macroeconomic cues and company news for stability.

3. Is Polycab India a good stock to buy in 2025?

Determining if Polycab India is a good buy requires analyzing its fundamentals and market conditions. Analysts are bullish, with Jefferies maintaining a “Buy” rating and a ₹7,150 target, citing a 26% EPS CAGR through FY28. Polycab’s 26-27% market share in wires and cables, debt-free balance sheet, and 20% ROE make it attractive. The FMEG segment’s profitability and the ₹6,447.54 crore BharatNet contract signal growth. However, risks include a high P/E ratio (38.32), raw material cost pressures, and a -17.49% YTD return.

Long-term investors may benefit from infrastructure and renewable energy trends, while short-term traders should watch technical indicators. Consult a financial advisor and use platforms like TradingView for technical analysis before investing.

4. How can I invest in Polycab India Share Price Today?

To invest in Polycab India Share Price Today, follow these steps:

- Open a Demat Account: Register with brokers like Groww, Dhan, or Kotak Securities using PAN, Aadhaar, and bank details.

- Complete KYC: Verify identity online for quick activation.

- Fund Account: Transfer funds via net banking or UPI.

- Search for Polycab: Use the stock symbol “POLYCAB” on NSE/BSE.

- Place Order: Buy at market price (₹6,297.50 as of June 23, 2025) or set a limit order.

- Monitor Investments: Track real-time prices and set SIPs for long-term growth.

Platforms like Dhan allow after-market orders and SIPs in Polycab shares. Always review financial reports and analyst ratings before investing. Start with small investments if you’re a beginner to manage risks.

5. What are the risks of investing in Polycab India in 2025?

Investing in Polycab India carries risks despite its strong fundamentals. The stock’s -17.49% YTD return and -0.26% monthly decline reflect market volatility. Rising raw material costs (copper, aluminum) could pressure margins, as seen during the February 2025 dip to ₹4,555.00. Competition from KEI Industries, R R Kabel, and Finolex Cables challenges market share. Global trade tensions and regulatory changes in infrastructure spending may impact EPC revenue.

Polycab’s P/E ratio of 38.32, higher than the sector’s 24.31, suggests a premium valuation, posing downside risk if earnings falter. Investors should diversify, monitor technical indicators, and stay updated via platforms like Moneycontrol to mitigate risks.

Conclusion

Polycab India Share Price Today (₹6,297.50 as of June 23, 2025) reflects its position as a leading electrical stock with strong fundamentals and growth potential. With a 26-27% market share in wires and cables, a debt-free balance sheet, and a ₹6,447.54 crore BharatNet contract, Polycab is well-poised for long-term success. Despite short-term volatility (-17.49% YTD), analyst optimism (Jefferies’ ₹7,150 target) and infrastructure demand make it a compelling pick.

Investors can start with a Demat account on Groww or Dhan, while exam aspirants can study Polycab’s role in India’s industrial growth. Share your investment strategies at [investinsights@gmail.com], comment below, or subscribe to our newsletter for stock market updates!

1 thought on “Polycab India Share Price Today 2025 : Your Guide to Investing in a Leading Electrical Stock”