IPO Allotment Status 2025:- The buzz around Initial Public Offerings (IPOs) in 2025 is electric, with companies like HDB Financial Services, Tata Capital, and Reliance Jio set to make waves in the stock market. For investors, the anticipation peaks when checking the IPO Allotment Status 2025, as it reveals whether you’ve secured shares in these high-potential ventures. The process can feel like waiting for a lottery result—exciting yet nerve-wracking.

This comprehensive guide demystifies the IPO allotment process, explains how to check your status, and breaks down the calculation methods. Whether you’re a retail investor or a high-net-worth individual (HNI), we’ll equip you with actionable insights to navigate IPO Allotment Status 2025 with confidence.

Understanding IPO Allotment Status 2025: What You Need to Know

An IPO allotment is the process of distributing shares to investors who applied during the IPO subscription period. Managed by a registrar (e.g., Link Intime, KFin Technologies), the allotment determines how many shares, if any, you receive. In 2025, SEBI’s updated rules ensure faster processing, especially for large-cap IPOs, making it critical to understand the timeline, process, and calculations.

What is IPO Allotment Status?

The IPO allotment status provides details on the number of shares allocated to an investor. It’s announced by the registrar on a specific date, typically within one week of the IPO closing, and is accessible online. Investors receive notifications via email or SMS from BSE, NSE, CDSL, or NSDL, ensuring transparency.

Why Checking IPO Allotment Status Matters

Checking your IPO Allotment Status 2025 helps you:

- Confirm whether you received shares and how many.

- Plan your next steps, such as preparing for the listing day or awaiting a refund.

- Understand the demand and oversubscription levels for the IPO.

The IPO Allotment Process in 2025

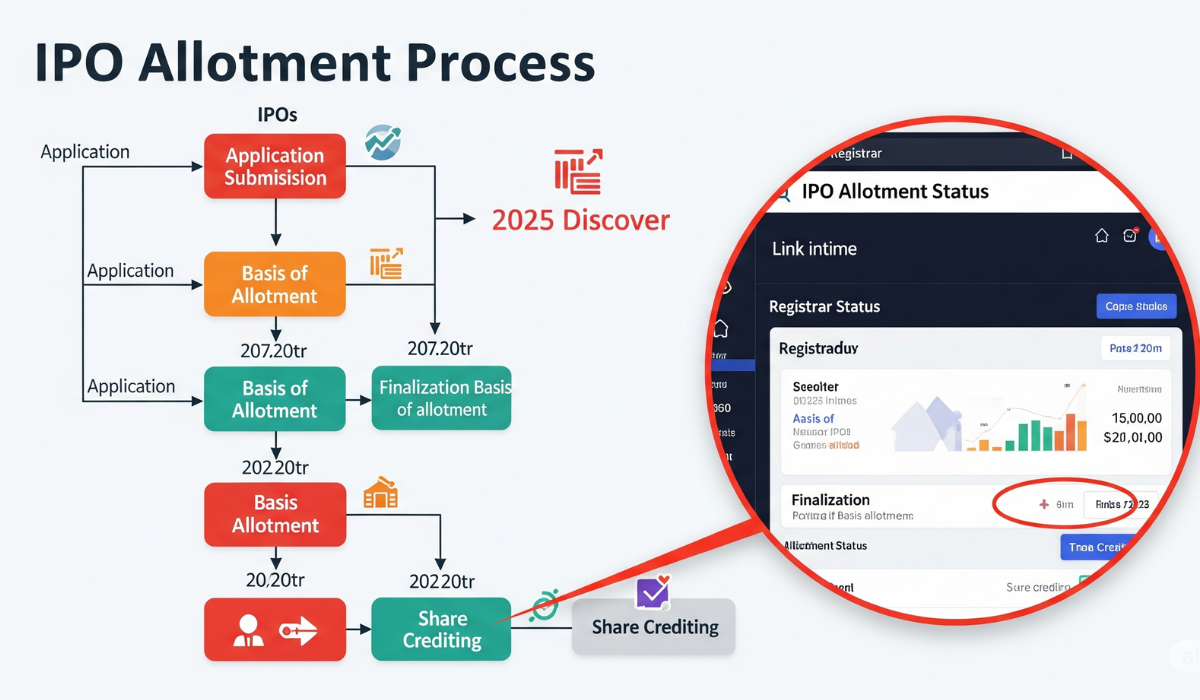

The IPO allotment process is systematic, governed by SEBI regulations to ensure fairness. Here’s a step-by-step breakdown:

Step 1: IPO Application Submission

Investors apply for IPO shares through a Demat account during the subscription window (typically 3-5 days). Applications are submitted via brokers (e.g., Zerodha, Upstox) or bank ASBA (Application Supported by Blocked Amount) facilities, where funds are blocked until allotment.

Step 2: Application Categorization

Applications are divided into categories:

- Retail Individual Investors (RII): Individuals applying for shares worth up to ₹2 lakh.

- Non-Institutional Investors (NII): High-net-worth individuals applying for over ₹2 lakh, split into Small NII (sNII) and Big NII (bNII) for IPOs with DRHPs filed after March 8, 2025.

- Qualified Institutional Buyers (QIB): Institutions like mutual funds and banks.

Each category has a reserved quota, ensuring retail investors compete only within their group.

Step 3: Allotment Calculation

The registrar calculates allotments based on subscription levels:

- Undersubscribed IPOs: All valid applicants receive their requested shares.

- Oversubscribed IPOs: Shares are allocated via a lottery for retail investors or proportionally for NIIs and QIBs.

For retail investors, SEBI mandates a minimum lot allocation before distributing additional shares. The registrar publishes a “Basis of Allotment” document detailing the allocation process.

Step 4: Allotment Announcement

The IPO allotment date is when the registrar announces the status, typically 3-7 days after the IPO closes. For large-cap IPOs in 2025, SEBI rules require allotment within 24 hours of closing, ensuring faster processing.

Step 5: Share Crediting and Refunds

Allocated shares are credited to Demat accounts before the listing date, while unallotted funds are refunded within 1-2 days post-allotment.

Example: For the HDB Financial Services IPO, allotment was finalized on July 7, 2025, with shares credited by July 8 and refunds initiated the same day.

How to Check IPO Allotment Status 2025

Checking your IPO Allotment Status 2025 is straightforward. Here are the primary methods:

Method 1: Registrar’s Website

Each IPO has a designated registrar (e.g., Link Intime, KFin Technologies, Bigshare Services). Follow these steps:

- Visit the registrar’s website (e.g., Link Intime or KFintech).

- Select the IPO name from the dropdown menu.

- Enter your PAN, application number, or Demat ID.

- Submit to view your allotment status.

Method 2: BSE and NSE Websites

Both stock exchanges provide allotment status:

- BSE: Visit bseindia.com, navigate to “Status of Issue Application,” and enter your details.

- NSE: Go to nseindia.com, select “IPO Application Status,” and input your PAN or application number.

Method 3: Broker Platforms

Brokers like Zerodha, Upstox, or Angel One notify investors via email, SMS, or their apps. Log into your trading account to check the status directly.

Tips for Checking:

- Keep your PAN, application number, or Demat ID handy.

- Check on the official allotment date (e.g., July 7 for HDB Financial Services IPO).

- Use a stable internet connection to avoid delays.

- Avoid unofficial websites to prevent scams.

IPO Allotment Calculation: How Shares Are Allocated

The IPO allotment calculation ensures fair distribution, especially in oversubscribed IPOs. Here’s how it works:

Retail Investor Allotment

For retail investors (RII), SEBI mandates:

- Minimum Lot Allocation: Each eligible applicant receives at least one lot (e.g., 10-100 shares, depending on the IPO).

- Lottery System: In oversubscribed IPOs, a computerized lottery determines allotments. For example, if 10,000 retail shares are available and 50,000 apply, the registrar divides shares by the minimum lot size to allocate to as many applicants as possible.

- Proportional Allocation: Remaining shares are distributed proportionally based on application size, if applicable.

Example: In the Ellenbarrie Industrial Gases IPO, retail investors applying for one lot had a firm allotment due to moderate oversubscription, while HNIs faced a lottery.

NII and QIB Allotment

- NII: Shares are allocated proportionally, with sNII and bNII subcategories receiving minimum lots first (for IPOs post-March 8, 2025). For example, HDB Financial Services allocated 280 shares to 5 out of 11 Big HNIs and 5 out of 31 Small HNIs.

- QIB: Allotments are proportional based on bid size and price, prioritizing long-term institutional investors.

Basis of Allotment Document

The registrar publishes this document, detailing:

- Total applications received.

- Oversubscription ratio per category.

- Number of shares allocated.

- Lottery or proportional allocation details.

Table: Sample Allotment Calculation (Hypothetical IPO)

| Category | Shares Available | Applications | Oversubscription | Allocation Method |

|---|---|---|---|---|

| Retail | 10,000 | 50,000 | 5x | Lottery (1 lot each) |

| Small NII | 5,000 | 10,000 | 2x | 1 lot + proportional |

| Big NII | 5,000 | 8,000 | 1.6x | Proportional |

| QIB | 20,000 | 25,000 | 1.25x | Proportional |

Source: Adapted from SEBI guidelines and Chittorgarh.

Case Study: HDB Financial Services IPO Allotment (July 2025)

The HDB Financial Services IPO, one of the most anticipated IPOs of 2025, closed its subscription on July 2, 2025. Here’s how its allotment unfolded:

- Subscription: Oversubscribed 4.5x in the shareholder category and moderately in retail.

- Allotment Date: July 7, 2025, announced by Link Intime.

- Allocation: Retail investors received firm allotments for single lots, while Small HNIs had a 5/31 chance of receiving 280 shares.

- Process: The registrar used a lottery for retail and proportional allocation for HNIs, with shares credited by July 8 and refunds initiated concurrently.

- Outcome: High demand led to a listing premium, rewarding allotted investors.

This case highlights the importance of checking the IPO Allotment Status 2025 promptly and understanding category-specific allocation rules.

Key Dates for IPO Allotment in 2025

The IPO allotment date varies by IPO but follows a predictable timeline:

- Large-Cap IPOs: Allotment within 24 hours of closing (SEBI rule).

- SME IPOs: Allotment within 3-7 days, depending on subscription levels.

- Notification: Investors receive SMS/email alerts from BSE, NSE, or the registrar.

Example Timeline (HDB Financial Services IPO):

- Subscription: June 30–July 2, 2025

- Allotment Date: July 7, 2025

- Refund Initiation: July 8, 2025

- Share Crediting: July 8, 2025

- Listing Date: July 9, 2025

Suggested Visual: A calendar graphic highlighting key IPO dates for June–July 2025, including HDB Financial Services and Ellenbarrie Industrial Gases.

Tips to Maximize IPO Allotment Chances

While allotments depend on demand, these strategies can improve your odds:

- Apply Early: Submit applications on the first day to avoid technical rejections.

- Use Multiple Demat Accounts: Apply through family members’ accounts to diversify applications.

- Bid at Cut-Off Price: For retail investors, bidding at the highest price ensures priority.

- Verify Details: Ensure PAN, Demat ID, and application details are error-free.

- Monitor Oversubscription: Check subscription status on BSE or NSE to gauge allotment chances.

FAQ Section

1. How do I check IPO Allotment Status 2025 online?

Answer: Checking your IPO Allotment Status 2025 is simple and can be done through multiple platforms. Start by visiting the registrar’s website, such as Link Intime or KFin Technologies. Select the IPO name, enter your PAN, application number, or Demat ID, and submit to view your status. Alternatively, use the BSE website (bseindia.com) under “Status of Issue Application” or the NSE website (nseindia.com) under “IPO Application Status.” Brokers like Zerodha or Angel One also provide status updates via their apps or email/SMS notifications. Ensure you check on the official allotment date (e.g., July 7 for HDB Financial Services IPO).

Keep your details handy, use a stable internet connection, and avoid unofficial websites to prevent scams. If shares are allotted, they’ll be credited to your Demat account before listing; otherwise, refunds are processed within 1-2 days.

2. What is the IPO allotment process in 2025?

Answer: The IPO allotment process in 2025 is a SEBI-regulated procedure managed by registrars like Link Intime or KFin Technologies. After the IPO subscription closes, applications are categorized into Retail Individual Investors (RII), Non-Institutional Investors (NII), and Qualified Institutional Buyers (QIB). For large-cap IPOs, SEBI mandates allotment within 24 hours of closing, while SME IPOs may take 3-7 days. In oversubscribed IPOs, retail investors receive shares via a lottery, ensuring at least one lot per eligible applicant, while NII and QIB allotments are proportional. The registrar publishes a “Basis of Allotment” document detailing applications, oversubscription, and allocation.

Shares are credited to Demat accounts, and refunds are processed for unallotted applications. For example, the Ellenbarrie Industrial Gases IPO used a lottery for retail allotments due to high demand. Check the registrar’s website or BSE/NSE for updates.

3. How is IPO allotment calculated for retail investors?

Answer: The IPO allotment calculation for retail investors prioritizes fairness under SEBI guidelines. In 2025, retail investors (applying for up to ₹2 lakh) are guaranteed a minimum lot if the IPO is oversubscribed. The registrar first allocates one lot to as many eligible applicants as possible via a computerized lottery. If shares remain, they’re distributed proportionally based on application size. For example, if an IPO offers 10,000 retail shares with a lot size of 100 and receives 50,000 applications, the registrar allocates shares to 100 applicants via lottery. If the IPO is undersubscribed, all applicants receive their requested shares.

The “Basis of Allotment” document details the process, including oversubscription ratios. For the HDB Financial Services IPO, retail investors received firm allotments for single lots due to moderate oversubscription. Always bid at the cut-off price to maximize chances.

4. What happens if I don’t get allotted shares in an IPO?

Answer: If you don’t receive shares in an IPO, your blocked funds (via ASBA) are refunded within 1-2 days after the IPO allotment status is announced. For instance, in the HDB Financial Services IPO, refunds were initiated on July 8, 2025, post-allotment on July 7. You’ll receive an SMS or email from BSE, NSE, or the registrar (e.g., Link Intime) confirming the refund. The amount is unblocked in your bank account, allowing you to reinvest in other IPOs or opportunities. To avoid repeated non-allotments, apply early, use multiple Demat accounts (e.g., family members’), and ensure accurate application details.

Check subscription levels on Moneycontrol to gauge oversubscription risks. If you’re new, platforms like 5Paisa offer guides to improve your IPO strategy. Don’t be discouraged—2025 offers numerous IPOs to try.

5. Why do some IPOs have delayed allotment status updates?

Answer: Delays in IPO Allotment Status 2025 updates can occur due to technical issues, high application volumes, or regulatory requirements. For SME IPOs, allotment may take longer (up to 7 days) if subscription thresholds aren’t met, unlike large-cap IPOs, which must finalize within 24 hours per SEBI rules. For example, posts on X noted delays in the Denta Water IPO allotment due to registrar issues with Integrated Registry. High oversubscription can also slow processing, as registrars like Bigshare Services handle thousands of applications.

To stay updated, check the registrar’s website (e.g., Bigshare) or BSE/NSE platforms regularly. Save your PAN and application number for quick access. If delays persist, contact your broker’s customer care for assistance. Always verify dates via the IPO prospectus to avoid confusion.

Conclusion: Stay Ahead in the 2025 IPO Game

Navigating IPO Allotment Status 2025 is a critical step for investors aiming to capitalize on high-potential IPOs like HDB Financial Services or Tata Capital. By understanding the IPO allotment process, checking status promptly on registrar or BSE/NSE websites, and leveraging strategies like early applications and multiple Demat accounts, you can maximize your chances. The systematic calculation methods, backed by SEBI regulations, ensure fairness, while timely notifications keep you informed. Stay proactive by monitoring key dates and subscription levels on trusted platforms like Chittorgarh or Bajaj Broking.

Have you applied for a 2025 IPO? Share your experiences in the comments or subscribe to our newsletter for the latest IPO updates!