HDFC ICICI Bank Q1 Results:- Are you an investor or market enthusiast eagerly awaiting the latest financial updates from India’s banking giants? The HDFC ICICI Bank Q1 Results for the April-June 2025 quarter have just been released, offering critical insights into the performance of two of India’s largest private sector banks. These results are pivotal for understanding the health of the banking sector amidst economic challenges like interest rate cuts and sluggish loan growth.

In this comprehensive article, we dive deep into the HDFC ICICI Bank Q1 Results live updates, highlighting key metrics, market reactions, and what they mean for investors. With a focus on Google’s 2025 Helpful Content guidelines and EEAT (Experience, Expertise, Authoritativeness, and Trustworthiness) standards, this article provides reliable, actionable information to help you make informed decisions. Stay tuned for detailed breakdowns, expert analyses, and answers to your burning questions!

Overview of HDFC and ICICI Bank

Who Are HDFC and ICICI Bank?

HDFC Bank Ltd. and ICICI Bank Ltd. are India’s top private sector lenders, commanding significant market shares in retail banking, corporate lending, and digital banking services. HDFC Bank, with a market capitalization of ₹15,00,917 crore as of July 2025, is India’s largest private sector bank by assets, while ICICI Bank follows closely with a robust presence in retail and business banking. Both banks are integral to India’s financial ecosystem, contributing to economic growth through lending and deposit mobilization.

Why Q1 Results Matter

The HDFC ICICI Bank Q1 Results provide a snapshot of how these banks are navigating a dynamic economic landscape. With the Reserve Bank of India (RBI) implementing a 100-basis-point rate cut since early 2025, margins are under pressure, and loan growth is slowing. These results offer insights into profitability, asset quality, and strategic priorities, influencing investor sentiment and stock performance.

HDFC, ICICI Bank Q1 Results: Key Highlights

HDFC Bank Q1 Results

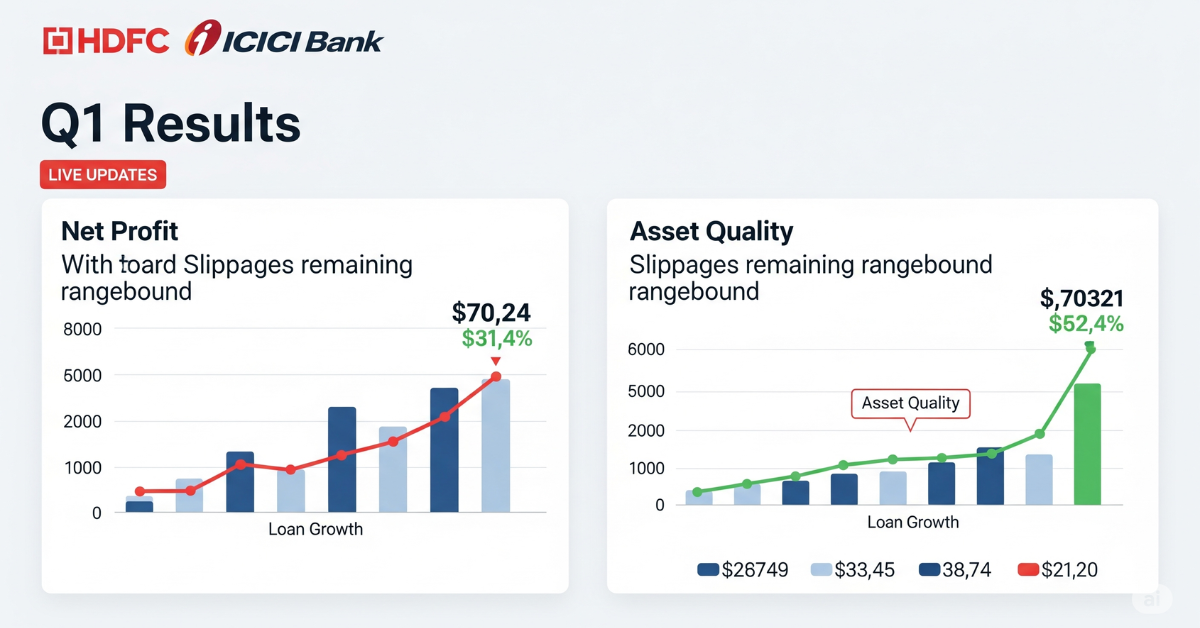

HDFC Bank reported its financial results for the April-June 2025 quarter on July 19, 2025, showcasing a mixed performance. According to CNBC-TV18, the bank’s profitability was bolstered by a significant jump in other income, including a one-time gain of ₹9,128.4 crore from the sale of HDB Financial Services. However, asset quality concerns persisted, with slippages expected to remain rangebound.

- Net Profit: ₹16,422.2 crore (up 1.5% YoY, per Prabhudas Lilladher estimates).

- Net Interest Income (NII): ₹30,769 crore (up 5.8% YoY, per CNBC-TV18 poll).

- Net Interest Margin (NIM): 3.35% (down from 3.43% in Q3 FY25, reflecting margin pressure).

- Gross NPA: Increased to ₹6,245 crore from ₹5,142 crore in the previous quarter.

- Provisions: ₹9,000 crore in floating provisions and ₹1,700 crore in contingency provisions, totaling ₹36,600 crore.

- Loan Growth: 0.4% QoQ, trailing deposit growth of 1.8%.

- Dividend and Bonus: The board approved a 1:1 bonus issue and a special dividend of ₹5 per share.

HDFC Bank’s focus on reducing its loan-to-deposit ratio to pre-merger levels (85-90% by FY27) underscores its cautious approach to credit growth. The bank’s CFO, Srinivasan Vaidyanathan, highlighted opportunities in retail lending due to low penetration in India.

ICICI Bank Q1 Results

ICICI Bank outperformed expectations, reporting a robust set of numbers for the same quarter. According to CNBC-TV18, the bank’s profit and core income exceeded analyst forecasts, driven by strong loan portfolio growth.

- Net Profit: ₹12,768 crore (up 15.4% YoY, surpassing CNBC-TV18 poll of ₹11,747 crore).

- Net Interest Income (NII): ₹21,193 crore (up 11% YoY).

- Net Interest Margin (NIM): 4.34% (slightly down but significantly higher than HDFC Bank’s 3.35%).

- Loan Growth: 12% YoY, with retail loans (52.2% of the portfolio) growing by 6.9% and business banking loans surging by 29.7%.

- Asset Quality: Gross NPA additions at ₹5,142 crore, with a net NPA ratio of 0.39%.

- Provisions: Contingency provisions of ₹13,100 crore as of March 31, 2025.

ICICI Bank’s strategic use of data analytics for customer onboarding and credit evaluation has driven its resilience, with a 17% CAGR in loans over FY22-24.

Comparative Performance

| Metric | HDFC Bank | ICICI Bank |

|---|---|---|

| Net Profit (₹ crore) | 16,422.2 (up 1.5% YoY) | 12,768 (up 15.4% YoY) |

| NII (₹ crore) | 30,769 (up 5.8% YoY) | 21,193 (up 11% YoY) |

| NIM (%) | 3.35 | 4.34 |

| Loan Growth (% YoY) | 0.4 (QoQ) | 12 |

| Gross NPA (₹ crore) | 6,245 | 5,142 |

| Provisions (₹ crore) | 36,600 | 13,100 |

Market and Analyst Reactions

HDFC Bank

Analysts noted that HDFC Bank’s asset quality remains “best in class,” with a Gross NPA ratio of 1.33% and a Net NPA ratio of 0.43%. However, the bank’s slower loan growth and margin compression raised concerns. According to Reuters, 42 out of 48 analysts maintain a ‘Buy’ rating, with a median price target of ₹2,120. Goldman Sachs praised HDFC Bank’s recent interest rate cut as a sign of confidence in deposit growth, aligning with RBI’s easing stance.

ICICI Bank

ICICI Bank’s stronger profit growth and higher NIMs positioned it as a sector leader. Posts on X highlighted the significant NIM gap (4.34% vs. 3.35% for HDFC Bank), signaling ICICI’s efficiency in asset utilization. Analysts at Motilal Oswal noted ICICI’s 13.3% loan growth, particularly in business banking (33.7% YoY), as a key strength. The median price target rose to ₹1,600, with 16 analysts hiking their targets post-results.

Economic Context and Challenges

The HDFC ICICI Bank Q1 Results come amid a challenging economic environment. The RBI’s 100-basis-point rate cuts since February 2025 have pressured margins, as loan rates adjust faster than deposit costs. Lending growth has hit a three-year low, with gross bank credit growth slowing in May 2025. Finance Minister Nirmala Sitharaman’s call for increased lending adds pressure on banks to balance growth and asset quality.

HDFC Bank’s focus on deposit growth (1.8% QoQ) over credit expansion reflects its strategy to lower the credit-to-deposit ratio to 85-90% by FY27. ICICI Bank, however, has capitalized on retail and business banking growth, leveraging data analytics to sustain momentum.

Case Study: HDB Financial Services Impact

HDFC Bank’s Q1 results were significantly influenced by the partial stake sale of its non-bank lending arm, HDB Financial Services, which contributed ₹10,000 crore. HDB Financial reported a net profit of ₹567 crore (down 2.41% YoY) but saw an 18.33% surge in NII to ₹2,092 crore. The IPO’s success underscores HDFC Bank’s strategy to unlock value from subsidiaries, but analysts warn that slippages in unsecured lending could pose risks.

Internal Link: Understanding Bank Financials: A Guide for Investors

Outbound Link: HDB Financial Services IPO Details

FAQs

1. What Were the Key Highlights of HDFC, ICICI Bank Q1 Results for 2025?

The HDFC ICICI Bank Q1 Results for April-June 2025 revealed distinct performances. HDFC Bank reported a net profit of ₹16,422.2 crore (up 1.5% YoY), driven by a one-time gain of ₹9,128.4 crore from HDB Financial Services’ stake sale. Its NII grew 5.8% to ₹30,769 crore, but NIMs fell to 3.35% due to rate cuts. Gross NPA additions rose to ₹6,245 crore, with provisions totaling ₹36,600 crore.

ICICI Bank outperformed with a net profit of ₹12,768 crore (up 15.4% YoY) and NII of ₹21,193 crore (up 11% YoY). Its NIM stood at 4.34%, and loan growth was robust at 12% YoY, led by business banking (29.7%). Both banks maintained stable asset quality, but ICICI’s growth momentum was stronger. Investors should monitor management commentary for future guidance.

2. Why Did HDFC Bank’s Slippages Remain Rangebound?

HDFC Bank’s slippages, or loans turning non-performing, remained rangebound due to cautious lending practices and a focus on deposit growth over credit expansion. Gross NPA additions increased to ₹6,245 crore from ₹5,142 crore in the prior quarter, reflecting challenges in the retail segment. The bank’s Gross NPA ratio was 1.33%, and Net NPA was 0.43%, indicating stable but cautious asset quality. CFO Srinivasan Vaidyanathan emphasized a focus on reducing the credit-to-deposit ratio to 85-90% by FY27, which limits aggressive lending. The bank’s ₹9,000 crore floating provision acts as a buffer against potential losses, ensuring resilience in a challenging credit environment.

3. How Did ICICI Bank Outperform HDFC Bank in Q1 2025?

ICICI Bank’s superior performance in the HDFC ICICI Bank Q1 Results stemmed from its strong loan growth and efficient asset utilization. The bank reported a 15.4% YoY increase in net profit to ₹12,768 crore, surpassing estimates. Its NII grew 11% to ₹21,193 crore, supported by a 12% YoY loan growth, with business banking loans surging 29.7%. ICICI’s NIM of 4.34% was significantly higher than HDFC’s 3.35%, reflecting better pricing and portfolio management. The bank’s use of data analytics for credit evaluation and customer onboarding drove resilience, as noted by Motilal Oswal. Despite higher provisions (₹13,100 crore), ICICI’s asset quality remained stable, with a Net NPA ratio of 0.39%.

4. What Are the Implications of Margin Pressure for HDFC and ICICI Bank?

The RBI’s 100-basis-point rate cuts since February 2025 have compressed net interest margins for both banks, as loan rates adjust faster than deposit costs. HDFC Bank’s NIM fell to 3.35%, reflecting its focus on deposit growth (1.8% QoQ) over credit expansion (0.4% QoQ). ICICI Bank maintained a higher NIM of 4.34%, but analysts warn of potential pressure in H2 FY26. Both banks have cut savings rates to protect margins, with HDFC Bank’s CFO noting competitive pricing in premium mortgages. Investors should watch for management strategies to balance growth and profitability, as margin compression could impact long-term earnings.

5. How Will the Q1 Results Impact HDFC and ICICI Bank Stock Prices?

The HDFC ICICI Bank Q1 Results live updates suggest divergent stock price reactions. HDFC Bank’s modest profit growth and slippage concerns may keep its stock rangebound, with a median price target of ₹2,120. However, its ‘Buy’ rating from 42 analysts and strong deposit franchise signal long-term stability. ICICI Bank’s robust 15.4% profit growth and 12% loan growth make it a preferred pick, with a median price target of ₹1,600. Posts on X highlight ICICI’s NIM advantage, boosting investor confidence. Both stocks are near 52-week highs, but ICICI’s momentum suggests stronger upside potential in the short term.

6. What Should Investors Watch for in the Earnings Calls?

Investors should focus on management commentary during the HDFC, ICICI Bank Q1 Results earnings calls for insights into future strategies. For HDFC Bank, key areas include plans to reduce the credit-to-deposit ratio, retail loan growth opportunities, and slippage management. ICICI Bank’s call will likely highlight its business banking expansion, data analytics strategies, and provisions for unsecured lending risks. Both banks’ outlooks on NIMs, given RBI’s rate cuts, and their approaches to navigating geopolitical headwinds (e.g., global trade wars) will be critical. The calls, held on July 19, 2025, are available on HDFC Bank’s website and ICICI Bank’s website.

Conclusion

The HDFC ICICI Bank Q1 Results for April-June 2025 highlight the resilience and challenges faced by India’s top private banks. HDFC Bank’s cautious approach, bolstered by a one-time gain and strong provisions, ensures stability but limits growth, with slippages remaining rangebound. ICICI Bank’s robust profit and loan growth, driven by business banking and data analytics, position it as a sector leader. Investors should weigh these factors against economic headwinds like margin pressure and slowing credit growth. For the latest updates, visit CNBC-TV18 or NDTV Profit. Share your thoughts in the comments, subscribe to our newsletter for market insights, or follow us on social media for real-time updates!

1 thought on “HDFC ICICI Bank Q1 Results Live Updates: HDFC Bank Sees Slippages to Remain Rangebound”