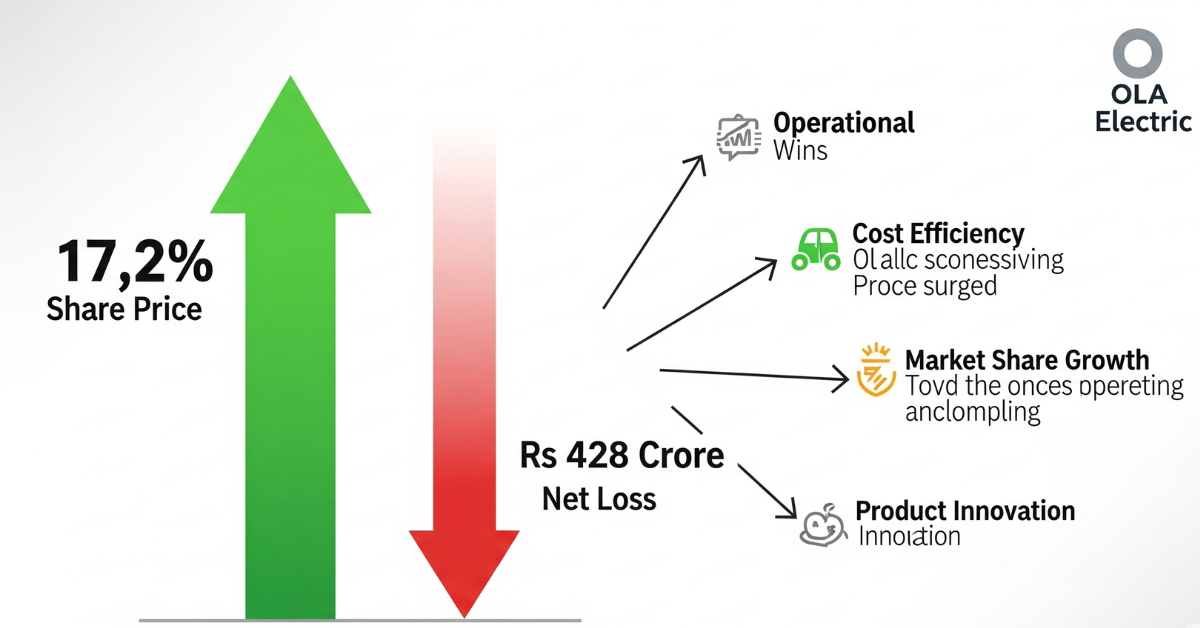

Ola Electric Shares :- The world of stock markets often presents paradoxes, where a company’s shares defy conventional wisdom, climbing sharply even as financial reports paint a picture of losses. Such was the case on a recent Monday for Ola Electric shares, which astonishingly climbed as much as 17.2%, reaching Rs 46.67 on the BSE. This remarkable rally occurred despite the company reporting a wider consolidated net loss of Rs 428 crore for the quarter ended June 2025.

At first glance, this scenario might appear counterintuitive to many investors. How can a company’s stock soar when its bottom line is bleeding? The answer lies in the nuanced analysis of financial statements and the forward-looking nature of stock markets. For Ola Electric, this surge wasn’t a random anomaly but a strong signal from investors who looked beyond the headline loss. They saw a company delivering a series of significant “operational wins” that, collectively, painted a compelling picture of a possible inflection point in its ambitious journey towards sustained profitability.

This article delves deep into the factors that fuelled this unexpected rally in Ola Electric shares, dissecting the operational achievements that have ignited investor optimism and reshaped the narrative around one of India’s most prominent electric vehicle (EV) manufacturers. We will explore how these strategic successes overshadow short-term financial setbacks, highlighting the long-term vision and execution that are captivating the market.

Understanding the Financial Snapshot: Q2 2025 Performance

Before we uncover the drivers behind the Ola Electric Shares rally, it’s essential to grasp the reported financial figures. For the quarter ended June 2025, Ola Electric recorded a consolidated net loss of Rs 428 crore. While this represents a widening of losses compared to the previous year, a deeper dive into the numbers reveals more than just the red ink.

Typically, a net loss would trigger a negative reaction from the market. However, seasoned investors understand that for high-growth, capital-intensive sectors like electric vehicles, initial years are often marked by significant investments in R&D, manufacturing infrastructure, market penetration, and brand building. These investments, while impacting short-term profitability, are crucial for future scale and market dominance.

The key to understanding the Ola Electric shares performance lies not just in the absolute loss figure but in how it compares to expectations and, more importantly, in the underlying operational metrics that indicate progress towards financial health. What did the market see that transcended the Rs 428 crore loss?

The Unseen Catalysts: Ola Electric’s Operational Wins

The “operational wins” are the true heroes of this Ola Electric Shares story. These are not just fleeting successes but fundamental improvements and strategic advancements that suggest a strong underlying business momentum. While the company may not have explicitly detailed every single “win” in public statements, market analysts and investors piece together indicators to form a confident outlook.

Let’s explore the categories of operational successes that likely contributed to the positive sentiment surrounding Ola Electric shares:

1. Significant Improvement in Unit Economics and Cost Efficiency

One of the most critical indicators for a loss-making company on a path to profitability is an improvement in its unit economics – the profitability per unit sold. For Ola Electric, this would mean:

- Reduced Bill of Materials (BOM): As production scales and the company optimizes its supply chain, the cost of raw materials and components for each EV unit manufactured should decrease. This could involve better procurement deals, in-house component manufacturing, or design efficiencies. A lower BOM directly improves gross margins per vehicle.

- Enhanced Manufacturing Efficiency: The Ola Futurefactory, one of the world’s largest two-wheeler manufacturing plants, constantly refines its processes. Improvements in automation, assembly lines, and waste reduction can lead to lower production costs per vehicle. This translates to higher output with optimized resources.

- Optimized Operating Expenses (OpEx): Beyond direct manufacturing costs, a company like Ola Electric incurs significant operational expenses, including marketing, R&D, and administrative costs. Strategic cost-cutting initiatives, without compromising essential growth drivers, are highly valued by investors. For instance, if Ola Electric demonstrated a significant reduction in per-unit marketing costs or an optimized R&D spend that yields quick results, it would signal strong financial discipline.

These improvements, even if they don’t immediately erase the net loss, demonstrate a clear trajectory towards sustainable profit margins, which is a powerful signal for investors in Ola Electric shares.

2. Strong Sales Volume Growth and Market Share Expansion

For a company in a nascent but rapidly expanding market like EVs, sales volume and market share are crucial metrics. Even if each unit isn’t highly profitable yet, increasing market penetration builds a formidable competitive moat and signals future revenue potential.

- Consistent Growth in EV Registrations: A significant quarter-on-quarter increase in the number of vehicles sold and registered. This demonstrates growing consumer acceptance and demand for Ola Electric’s offerings.

- Dominance in Key Segments: Maintaining or expanding its leadership position in the electric scooter segment, or showing strong entry into new categories like electric motorcycles or even four-wheelers, indicates successful product strategy and market capture.

- Effective Distribution Network Expansion: Widening its reach through new dealerships, experience centers, or a robust direct-to-consumer model enhances sales accessibility and market penetration.

Investors often prioritize top-line growth and market leadership in early-stage growth companies, betting that profitability will follow once scale is achieved. The sustained upward trend in sales volume strengthens the long-term outlook for Ola Electric Shares .

3. Product Portfolio Expansion and Technological Advancements

Innovation is the lifeblood of the EV industry. Ola Electric’s ability to consistently introduce new, competitive products and showcase technological prowess is a major win.

- Successful New Model Launches: The introduction of new scooter variants, electric motorcycles (like the Ola Roadster), or even glimpses into their upcoming electric car projects can excite the market. These new models, especially those targeting different price points or performance segments, broaden the addressable market.

- Battery Technology Breakthroughs: Batteries are the heart of EVs, often accounting for a significant portion of the cost. Any advancements in battery efficiency, range, charging speed, or cost reduction (e.g., through in-house cell manufacturing) are monumental wins.

- Software and AI Integration: Ola’s MoveOS platform and its integration of AI for navigation, vehicle performance, and user experience set it apart. Continuous updates and new features that enhance the user experience can foster brand loyalty and attract new customers.

- Charging Infrastructure Development: While often a separate entity, progress in building a robust charging network (e.g., Hypercharger network expansion) is vital for mass EV adoption and directly supports vehicle sales.

These product and technological “wins” demonstrate the company’s long-term competitive advantage and its ability to stay ahead in a rapidly evolving landscape, making Ola Electric shares an attractive long-term bet.

4. Positive Cash Flow Trends and Funding Stability

While the company reported a net loss, investors are highly attuned to cash burn and liquidity. “Operational wins” might also include improvements in cash flow from operations, indicating that the core business is becoming less reliant on external funding for day-to-day activities.

- Reduced Cash Burn: A significant decrease in the rate at which the company is using its cash reserves signals improved financial health and a longer runway for achieving profitability.

- Successful Fundraises or Strategic Investments: Even if the company posted a loss, news of successful funding rounds or strategic investments from major players can inject confidence, providing the necessary capital for continued expansion and R&D.

- Optimized Working Capital Management: Efficient management of inventory, receivables, and payables can free up cash, contributing to a healthier balance sheet.

These financial management indicators, though not directly part of the profit and loss statement, are critical in evaluating the stability and future prospects of Ola Electric shares.

Why Investors Look Beyond the Loss: The Growth Stock Mentality

The phenomenon of Ola Electric shares soaring despite a net loss is a classic example of how growth stock valuations work. Investors in high-growth, disruptive companies often prioritize future potential over current profitability. Here’s why:

- Future Market Dominance: In nascent industries like EVs, the company that captures significant market share early on has the potential to become a dominant player as the market matures. Current losses are seen as investments in securing this future dominance.

- Scalability: Investors look for companies that can scale their operations rapidly once profitability is achieved. Ola Electric’s large-scale manufacturing capabilities and expansive network suggest this potential.

- Technological Moat: Companies with proprietary technology or significant R&D lead can create a competitive barrier. The market is willing to pay a premium for such innovation.

- Inflection Point Theory: The concept of an “inflection point” suggests a moment where a company’s trajectory fundamentally changes, shifting from a period of heavy investment and losses to one of sustainable growth and profitability. The “operational wins” strongly indicate that Ola Electric is nearing or has reached such a point.

- Investor Sentiment and Narrative: Sometimes, a compelling narrative about a company’s vision, leadership, and perceived impact on the future (e.g., sustainable mobility) can drive investor enthusiasm, even in the face of short-term challenges.

The market’s reaction to Ola Electric’s Q2 2025 results reflects a strong belief that the company is effectively executing its strategy, laying the groundwork for a profitable future, and is nearing the threshold where its revenues will consistently outpace its operational costs, driven by the strong demand for the electric vehicles produced by the company.

The Broader EV Market Context in India

Ola Electric operates within a rapidly evolving and highly competitive Indian EV market. Understanding this landscape provides crucial context for its performance and the investor sentiment around Ola Electric shares.

India’s push for electric mobility is driven by several factors:

- Government Incentives: Schemes like FAME II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) provide subsidies for EV purchases and charging infrastructure development.

- Rising Fuel Costs: Volatile petrol and diesel prices make EVs an increasingly attractive alternative for consumers seeking lower running costs.

- Environmental Concerns: Growing awareness about air pollution and climate change is pushing consumers and policymakers towards cleaner transportation.

- Technological Advancements: Continuous improvements in battery technology, range, and charging speed are making EVs more practical and appealing.

While competition is intensifying with new entrants and traditional automakers ramping up their EV portfolios, Ola Electric’s early mover advantage and aggressive expansion strategy position it strongly. The market surge for Ola Electric shares suggests that investors believe the company is well-equipped to capitalize on this burgeoning market opportunity.

Strategic Outlook and Future Projections

Looking ahead, the market will keenly watch Ola Electric’s ability to maintain its operational momentum and translate these “wins” into sustained financial profitability. Key areas of focus for future quarters will include:

- Path to Profitability: Clearer timelines and milestones for achieving positive EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and eventually, net profit.

- New Product Pipeline: The successful launch and market acceptance of its new models, particularly the Roadster and any future electric cars.

- Scalability of Production: The ability to ramp up manufacturing at the Ola Futurefactory to meet growing demand efficiently.

- Expansion of Charging Network: A robust and accessible charging infrastructure is critical for consumer confidence and broader adoption.

- Global Expansion: While primarily focused on India, any strategic moves towards international markets could significantly boost long-term growth prospects.

The Q2 2025 results, despite the loss, have reinforced the market’s conviction in Ola Electric’s strategic direction and operational capabilities. The strong rally in Ola Electric Shares price reflects a collective belief that the company is not just surviving but thriving, setting the stage for a promising future in the Indian EV landscape.

Frequently Asked Questions (FAQs) about Ola Electric’s Performance and Share Outlook

Q1: Why did Ola Electric shares surge despite reporting a significant net loss of Rs 428 crore in Q2 2025?

Ola Electric shares climbing by over 17% to Rs 46.67 on the BSE, despite a consolidated net loss of Rs 428 crore for the quarter ended June 2025, initially appears counterintuitive to conventional investment wisdom which typically expects profitability to drive stock performance. However, this rally is a testament to the forward-looking nature of stock markets, especially concerning high-growth, disruptive companies in nascent sectors like electric vehicles (EVs). Investors looked beyond the immediate loss and focused keenly on Ola Electric’s underlying “operational wins” and strategic progress.

These operational successes signal a possible “inflection point” – a crucial moment where the company’s trajectory shifts from heavy investment and initial losses towards a clear path of future profitability and market dominance.

Specifically, the market’s positive reaction was likely driven by several key factors. Firstly, significant improvements in Ola Electric’s unit economics, such as a reduction in the “Bill of Materials” (BOM) per vehicle and enhanced manufacturing efficiencies at the Ola Futurefactory, demonstrate a disciplined approach to cost management. These improvements suggest that while the company is still in its investment phase, it is becoming more efficient with each unit produced, narrowing its path to achieving positive gross margins.

Secondly, strong sales volume growth and continued expansion of market share are pivotal. In a rapidly expanding EV market, capturing a larger slice of the pie, even if not immediately profitable on a net basis, builds a formidable competitive advantage and promises substantial future revenue. Consistent increases in EV registrations and the successful penetration into new geographic markets or consumer segments would have instilled confidence. Thirdly, advancements in product innovation and technology are critical.

The successful launch of new models, breakthroughs in battery technology (e.g., improved range, faster charging, or cost-efficient in-house production), and continuous enhancements to its proprietary MoveOS software platform, all reinforce Ola Electric’s competitive edge and its ability to attract and retain customers in a fiercely competitive landscape. Lastly, improved cash flow trends, particularly a reduced cash burn rate or successful capital raises that provide sufficient liquidity for ongoing operations and future expansion, are vital indicators for investors.

These combined operational victories indicate that Ola Electric is executing its long-term strategy effectively, and the market is pricing in the anticipated future value and profitability that these operational gains are expected to yield.

Q2: What are “operational wins” for an EV company like Ola Electric, and how do they impact investor sentiment?

For an electric vehicle (EV) company like Ola Electric, “operational wins” refer to a range of strategic and execution successes that demonstrate robust underlying business health and future potential, even if the company is not yet net profitable. These wins go beyond simple sales numbers and delve into the efficiency, innovation, and market positioning of the company’s core operations. Key operational wins include: production efficiency improvements (e.g., optimizing assembly lines, reducing manufacturing defects, increasing output capacity), cost reduction initiatives.

(e.g., negotiating better supplier deals, vertical integration to produce components in-house like battery cells, streamlining logistics), technological advancements (e.g., developing more efficient battery packs, extending vehicle range, improving charging speeds, enhancing software features through updates like MoveOS), and successful market penetration strategies (e.g., expanding charging infrastructure, opening new experience centers, entering new vehicle segments like electric motorcycles or cars, building strong brand loyalty).

These operational achievements profoundly impact investor sentiment because they provide concrete evidence of a company’s ability to execute its business plan and achieve long-term sustainability. While a net loss indicates current financial expenditure outweighs revenue, “operational wins” signal that this expenditure is yielding tangible, strategic results that are building future value. Investors are typically willing to tolerate short-term losses in high-growth, capital-intensive sectors if they see clear progress towards a scalable and profitable business model.

For Ola Electric shares, demonstrating improved gross margins per vehicle, increasing vehicle deliveries month-on-month, showing advancements in its proprietary technology, or achieving milestones in its charging network expansion, all convey that the company is effectively managing its core business and moving closer to profitability. This signals reduced future risk and increased future earnings potential, making Ola Electric an attractive long-term investment. It shifts the market’s perception from a company burning cash to one investing intelligently in its future, thus driving up Ola Electric Share value.

Q3: How does the Indian EV market outlook contribute to investor confidence in Ola Electric despite its losses?

The bullish outlook for the Indian Electric Vehicle (EV) market significantly contributes to investor confidence in Ola Electric, even when the company reports losses. India is emerging as one of the fastest-growing EV markets globally, driven by a confluence of supportive government policies, increasing environmental consciousness, and a burgeoning consumer base seeking cost-effective and sustainable transportation solutions. The Indian government has set ambitious targets for EV adoption, backed by initiatives like the FAME II scheme, which provides financial incentives for EV purchases and supports the development of charging infrastructure.

Furthermore, a new manufacturing policy for foreign EV makers, aiming to attract investments, underscores the government’s commitment to fostering a robust EV ecosystem. These policy tailwinds create a fertile ground for companies like Ola Electric to thrive.

Investors are betting on the long-term growth trajectory of this market, understanding that initial losses are often a necessary trade-off for capturing early market share and establishing dominance in a nascent industry. Ola Electric’s aggressive expansion, large-scale manufacturing capabilities at the Ola Futurefactory, and its integrated approach (from vehicle manufacturing to battery technology and charging infrastructure) position it as a potential market leader. The high cost of petrol and diesel in India further accelerates the shift towards electric mobility, making EVs a more economical choice for consumers over their lifecycle.

Therefore, despite a Rs 428 crore loss in Q2 2025, the market sees Ola Electric Shares as a frontrunner poised to capitalize on India’s inevitable EV revolution. The belief is that as the market matures and EV adoption skyrockets, Ola Electric Shares current investments and operational scale will translate into substantial long-term profits, making the current financial setback a temporary phase in a much larger growth story for Ola Electric shares. This future potential, underpinned by a supportive market environment, is a major driver of positive investor sentiment.

Q4: What is the significance of the “inflection point” for a company like Ola Electric, and how does it relate to its share price performance?

The “inflection point” is a critical concept in business and finance, signifying a moment where a company’s trajectory fundamentally changes, moving from one phase to another. For a growth-stage company like Ola Electric Shares, particularly one reporting losses, reaching an “inflection point” means a transition from a period of heavy capital expenditure, market development, and negative profitability to a phase of accelerated growth, improving unit economics, and a clear, visible path to sustained profitability.

This turning point is not necessarily marked by immediate net profit but rather by a set of operational and strategic achievements that strongly indicate future financial success.

In the context of Ola Electric shares surging despite a Rs 428 crore loss in Q2 2025, the “inflection point” implies that investors perceive the company has crossed a threshold where its significant investments are now beginning to yield tangible, positive outcomes at an accelerating pace. These outcomes, referred to as “operational wins,” could include:

- Cost Curve Improvement: Reaching a scale of production where the cost per unit of manufacturing electric vehicles significantly declines.

- Market Leadership Consolidation: Firmly establishing dominance or a very strong second position in key EV segments.

- Technological Maturity: Moving beyond initial R&D to a phase where proprietary technology provides a distinct competitive advantage and is ready for mass deployment.

- Operational Cash Flow Breakeven: The core business generating enough cash to cover its day-to-day operations, reducing reliance on external funding.

The significance for Ola Electric Shares price is immense. Before an inflection point, investor sentiment can be volatile, as the company’s future remains uncertain. However, once the market identifies an inflection point, it signals reduced risk and increased confidence in the company’s long-term viability and profitability. This leads to a re-rating of the stock, where its valuation shifts from being based on current losses to being based on highly anticipated future earnings.

The 17.2% surge in Ola Electric shares despite the Q2 loss suggests that a significant portion of the market now believes the company has indeed hit or is very close to this crucial inflection point, justifying a premium valuation based on its promising future. It implies that the foundational work and investments are now starting to pay off, paving the way for a more stable and lucrative future for the company and its shareholders.

Conclusion: A Glimpse into Ola Electric’s Promising Horizon

The recent surge in Ola Electric shares to Rs 46.67 on the BSE, defying a reported consolidated net loss of Rs 428 crore for the quarter ended June 2025, is a powerful reminder that stock market valuations are often driven by future expectations rather than just past or current financial figures. This rally underscores a growing investor confidence rooted in Ola Electric’s demonstrated “operational wins” – from improvements in unit economics and manufacturing efficiency to strong sales growth, product innovation, and strategic market expansion.

These achievements collectively signal that Ola Electric is not merely spending, but investing wisely, laying down the essential groundwork for a sustainable and profitable future in India’s booming EV sector. The market perceives the company to be at a critical inflection point, where its aggressive investments are beginning to mature and translate into tangible progress towards profitability.

For investors, the narrative around Ola Electric Shares is shifting from one of a high-burn startup to a maturing industry leader poised to capitalize on the enormous potential of electric mobility in India. As the company continues to execute its strategy, deliver innovative products, and expand its footprint, the market will keenly watch its journey towards sustained financial success.

What are your thoughts on Ola Electric’s journey? Share your insights and perspectives in the comments below! Don’t forget to share this article with fellow investors interested in the future of electric vehicles in India.

1 thought on “Ola Electric Shares Surge Over 17% Despite Posting Rs 428 Crore Loss in Q2: Here’s Why the Market is Bullish”