Siemens Energy Shares List:- Are you an investor eager to understand the excitement around the Siemens Energy shares list on the NSE? On June 19, 2025, Siemens Energy India Ltd. made a blockbuster debut, listing at ₹2,840 per share on the National Stock Exchange (NSE) and swiftly hitting a 5% upper circuit, locking at ₹2,982. This milestone follows the demerger of Siemens Ltd.’s energy business, creating India’s largest pure-play power transmission and distribution (T&D) equipment company. For shareholders of Siemens Ltd. and new investors, this event opens up promising opportunities in India’s rapidly growing energy sector.

Siemens Energy Shares List: Key Details

The Siemens Energy shares list on June 19, 2025, marks the culmination of Siemens Ltd.’s strategic demerger, approved by the National Company Law Tribunal (NCLT) on March 26, 2025. The new entity, Siemens Energy India Ltd., focuses on power generation, transmission, and industrial applications, positioning it as a leader in India’s T&D sector. The shares debuted at ₹2,840 on the NSE and hit the 5% upper circuit at ₹2,982, reflecting strong investor demand. The listing aligns with India’s ₹9.2 lakh crore T&D capex pipeline, making Siemens Energy India a key player in the country’s energy transformation.

Listing Performance

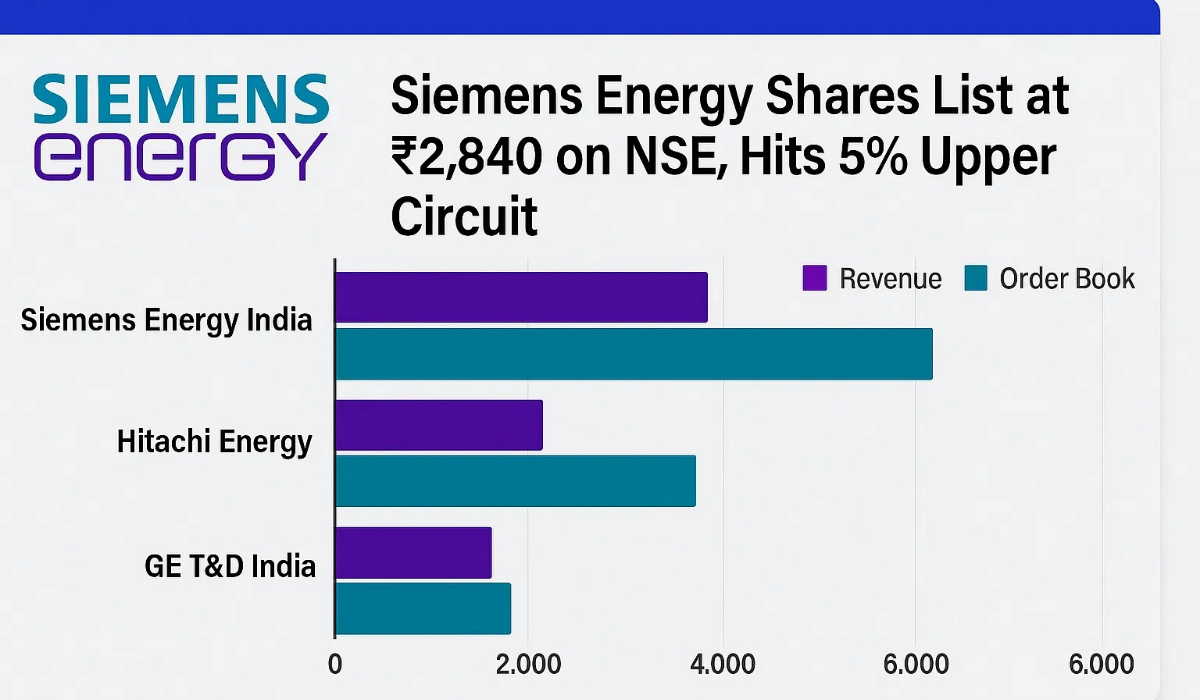

Siemens Energy India Ltd. listed on both the NSE and BSE under the T Group (Trade-to-Trade) for the first 10 days, as mandated for new listings to curb speculative trading. The shares opened at ₹2,840, closely matching Jefferies’ estimated range of ₹2,995–₹3,711 and HDFC Securities’ implied price of ₹2,478. The immediate 5% upper circuit underscores robust market confidence, driven by the company’s strong fundamentals and India’s energy sector growth. The market capitalization exceeded $10 billion, surpassing competitors like Hitachi Energy ($6.8–$9.6 billion) and GE T&D India.

Demerger Background

The demerger, effective April 7, 2025, allocated one Siemens Energy India share for every Siemens Ltd. share held in a 1:1 ratio. Siemens Ltd. shareholders as of the record date (April 7, 2025) received 35.6 crore shares, credited on April 15, 2025. The process followed Siemens AG’s global spin-off of its energy business in 2020, with India’s demerger creating two independent entities:

- Siemens Ltd.: Focused on digital industries, smart infrastructure, and mobility.

- Siemens Energy India: Dedicated to energy solutions, including grid technologies and power generation.

This separation enhances financial flexibility and unlocks value for shareholders, as evidenced by the strong debut of the Siemens Energy shares list.

Financial Snapshot

Siemens Energy India’s financial performance underpins its market debut:

- Revenue (FY24): ₹6,280 crore

- EBITDA Margin: 15.7%

- Net Profit: ₹710 crore

- Order Book: ₹10,050 crore as of December 2024, with ₹8,800 crore in new orders in FY24

These metrics highlight the company’s operational strength and growth potential, with analysts projecting a 24% revenue CAGR and 40% EPS CAGR over FY24–27, driven by India’s T&D investments and operating leverage.

Table: Siemens Energy India Financial Highlights (FY24)

| Metric | Value |

|---|---|

| Revenue | ₹6,280 crore |

| EBITDA Margin | 15.7% |

| Net Profit | ₹710 crore |

| Order Book | ₹10,050 crore |

| New Orders (FY24) | ₹8,800 crore |

Drivers of the Siemens Energy Shares List Success

India’s T&D Capex Boom

India’s power sector is undergoing a transformation, with a ₹9.2 lakh crore T&D capex pipeline projected over the next decade. Siemens Energy India is uniquely positioned to benefit, offering:

- Grid Technologies: Transformers, switchgear, and smart grid solutions.

- Industrial Power Generation: Turbines and generators for industrial applications.

- Gas Services: Maintenance and upgrades for gas-based power plants.

- Project Execution: Turnkey solutions for power generation and transmission.

The company’s ₹150 billion order backlog (2.1x FY25E revenue) and 22.6% EBITDA margins reflect its ability to capitalize on this structural uptick.

Technology Leadership

Siemens Energy India’s proprietary technologies, including smart grid systems and energy automation, give it a competitive edge. Its focus on decarbonization aligns with India’s 500 GW renewable energy target by 2030, driving demand for its solutions. Posts on X highlight the company’s leadership, with @EquiNews_India noting its $10 billion+ market cap and technology-driven growth.

Strong Order Pipeline

The company secured ₹8,800 crore in new orders in FY24, contributing to a ₹10,050 crore order book. This pipeline, coupled with a favorable pricing environment, is expected to drive 18% EBITDA margins in FY25, according to IIFL Securities. The robust order inflow underscores Siemens Energy India’s market dominance and operational scalability.

Case Study: Ms. Sharma, a Siemens Ltd. shareholder with 300 shares as of April 7, 2025, received 300 Siemens Energy India shares post-demerger. At the listing price of ₹2,840, her holding is valued at ₹8,52,000, with potential upside to ₹11,10,000 based on Jefferies’ ₹3,700 target. Her Siemens Ltd. shares, trading at ₹3,354.7 on June 17, 2025, are worth ₹10,06,410, demonstrating the demerger’s value creation.

Market Impact and Investor Sentiment

The Siemens Energy shares list generated significant market buzz, with shares locking at the 5% upper circuit within minutes of trading. On X, users like @SumitResearch and @Vismaya9999 praised the listing, citing brokerage targets and the company’s T&D leadership. However, @BigBreakingWire noted potential passive outflows of $170–180 million due to MSCI’s removal of Siemens Energy India from the Global Standard Index on June 20, 2025, which could introduce short-term volatility.

Analyst Projections

Brokerages are overwhelmingly positive:

- Jefferies: Buy, target ₹3,700, projecting 40% EPS CAGR over FY24–27. Values the stock at 62x FY27 P/E, a 13% discount to Hitachi Energy.

- HDFC Securities: Buy, target ₹3,000, emphasizing T&D pipeline benefits.

- Antique: Buy, target ₹3,179, highlighting technology and scale advantages.

- IIFL Securities: Base case target ₹3,375, with a 45x P/E ratio.

These targets suggest a 13–32% upside from the listing price, driven by India’s energy sector growth and Siemens Energy India’s operational efficiency.

Impact on Siemens Ltd.

Post-demerger, Siemens Ltd. shares adjusted significantly, opening at ₹2,571 on April 7, 2025, a 48% drop from ₹4,939.80 due to the subtraction of the energy business. However, the stock recovered to ₹3,354.7 by June 17, 2025, up 1.96% from its previous close. Analysts remain bullish, with PL Capital (target ₹3,233) and Antique (target ₹4,336) citing Siemens Ltd.’s focus on electrification, automation, and digitalization.

Siemens Energy India: Business Strengths

Portfolio Overview

Siemens Energy India operates across four key segments:

- Grid Technologies: Solutions for low and medium voltage distribution, smart grids, and energy automation.

- Industrial Power Generation: Turbines and generators for industrial clients.

- Gas Services: Maintenance and optimization for gas-based power plants.

- Project Execution: Turnkey solutions for utilities and industrial projects.

The energy vertical contributed 35% to Siemens Ltd.’s revenue and 40% to its EBIT from FY21–24, underscoring its profitability.

Competitive Edge

Siemens Energy India is India’s largest pure-play T&D equipment player, outpacing competitors like Hitachi Energy and GE T&D India. Its strengths include:

- Market Leadership: $10 billion+ market cap, larger than peers.

- Order Backlog: ₹150 billion, ensuring revenue visibility.

- Technology: Proprietary solutions for decarbonization and grid modernization.

- Scale: Ability to execute large-scale projects, supported by Siemens AG’s global expertise.

These factors position Siemens Energy India as a key beneficiary of India’s energy transition, as noted by Jefferies and Antique.

Growth Outlook

Analysts project:

- Revenue Growth: 24% CAGR over FY24–27, driven by T&D capex.

- Margin Expansion: EBITDA margins rising to 18% in FY25.

- EPS Growth: 40% CAGR, supported by operating leverage and pricing power.

The company’s focus on renewable energy and smart grids aligns with India’s sustainability goals, enhancing its long-term prospects.

How Investors Can Capitalize

To benefit from the Siemens Energy shares list, investors should:

- Hold for Long-Term Growth: Retain shares to capitalize on the projected 40% EPS CAGR.

- Monitor Index Adjustments: Watch for volatility from MSCI outflows ($170–180 million) and potential FTSE index changes post-June 20, 2025.

- Verify Demat Credits: Ensure Siemens Energy India shares are credited post-allotment and bank details are updated for future dividends.

- Diversify Portfolio: Combine with Siemens Ltd. shares for exposure to both energy and digital infrastructure sectors.

Example: Mr. Rao, holding 500 Siemens Ltd. shares, received 500 Siemens Energy India shares. At ₹2,840, his Siemens Energy holding is worth ₹14,20,000, with a potential value of ₹18,50,000 at Jefferies’ ₹3,700 target. His Siemens Ltd. shares, at ₹3,354.7, are valued at ₹16,77,350, offering a balanced portfolio.

Risks to Consider

While the Siemens Energy shares list is promising, investors should note:

- Index Outflows: MSCI’s removal from the Global Standard Index on June 20, 2025, may trigger $170–180 million in passive selling, causing short-term price pressure.

- Macro Risks: Rising material costs or delays in T&D projects could impact margins.

- Competition: Hitachi Energy and GE T&D India remain strong competitors in the T&D space.

- Market Volatility: T Group trading for 10 days may limit liquidity.

Despite these risks, Siemens Energy India’s strong order book and technology leadership mitigate concerns, as highlighted by Antique and HDFC Securities.

FAQ: Siemens Energy Shares List and Key Details

1. What is the Siemens Energy shares list price and performance on June 19, 2025?

The Siemens Energy shares list price was ₹2,840 per share on the NSE on June 19, 2025, with the stock hitting a 5% upper circuit at ₹2,982 within minutes. On the BSE, the shares opened similarly and followed the same trend. This debut aligned with Jefferies’ estimated range of ₹2,995–₹3,711 and HDFC Securities’ implied price of ₹2,478, reflecting strong investor demand. The company’s $10 billion+ market cap positions it as India’s largest pure-play T&D equipment player, ahead of Hitachi Energy ($6.8–$9.6 billion). The shares traded in the T Group for 10 days, limiting speculative activity.

Posts on X noted potential volatility due to MSCI’s index removal on June 20, 2025, with estimated passive outflows of $170–180 million. Brokerages like Jefferies (target ₹3,700) and Antique (target ₹3,179) remain optimistic, projecting a 13–32% upside.

2. How did shareholders receive Siemens Energy India shares?

Siemens Energy India shares were allotted in a 1:1 ratio to Siemens Ltd. shareholders as of the record date, April 7, 2025. For every Siemens Ltd. share held, investors received one Siemens Energy India share, with 35.6 crore shares credited on April 15, 2025. The demerger, approved by the NCLT on March 26, 2025, followed Siemens AG’s global spin-off of its energy business in 2020. The listing occurred on June 19, 2025, within the 60–90-day timeline projected by IIFL Securities.

For example, an investor with 1,000 Siemens Ltd. shares received 1,000 Siemens Energy India shares, valued at ₹28,40,000 at the listing price of ₹2,840. Investors should verify share credits in their demat accounts and ensure bank details are updated for future dividends. Check www.nseindia.com for official updates.

3. What is Siemens Energy India’s business focus and growth potential?

Siemens Energy India focuses on grid technologies (transformers, switchgear), industrial power generation (turbines, generators), gas services, and turnkey project execution. In FY24, it reported ₹6,280 crore in revenue, a 15.7% EBITDA margin, and a ₹710 crore net profit, with a ₹10,050 crore order book. Analysts project a 24% revenue CAGR and 40% EPS CAGR over FY24–27, driven by India’s ₹9.2 lakh crore T&D capex pipeline and decarbonization trends. Jefferies values the stock at ₹3,700 (62x FY27 P/E), while IIFL Securities targets ₹3,375 (45x P/E).

The company’s technology leadership and ₹150 billion order backlog ensure strong cash flows and scalability. Risks include MSCI outflows and material cost pressures, but its market dominance mitigates these. For updates, visit www.siemens.com/in.

4. What are the risks of investing in Siemens Energy India?

Investing in Siemens Energy India carries risks, including:

- Index Outflows: MSCI’s removal from the Global Standard Index on June 20, 2025, could trigger $170–180 million in passive outflows, causing short-term volatility.

- Macro Challenges: Rising material costs or T&D project delays could impact margins.

- Competition: Hitachi Energy and GE T&D India are strong rivals in the T&D sector.

- Liquidity Constraints: T Group trading for 10 days may limit early trading flexibility.

However, the company’s ₹10,050 crore order book, 22.6% EBITDA margins, and technology edge mitigate risks. Brokerages like HDFC Securities (target ₹3,000) and Antique (target ₹3,179) highlight its structural growth potential in India’s energy sector. Investors should monitor FTSE index adjustments post-listing and hold for long-term gains.

5. How does Siemens Energy India compare to competitors?

Siemens Energy India is India’s largest pure-play T&D equipment player, with a $10 billion+ market cap, surpassing Hitachi Energy ($6.8–$9.6 billion) and GE T&D India. Its strengths include:

- Technology: Proprietary smart grid and decarbonization solutions.

- Order Book: ₹10,050 crore, with a 24% revenue CAGR projected.

- Scale: Ability to execute large-scale projects, backed by Siemens AG.

Hitachi Energy and GE T&D India have strong portfolios but trail in market cap and order backlog. Jefferies values Siemens Energy at a 13% discount to Hitachi, with a 62x FY27 P/E ratio, suggesting upside potential. The Siemens Energy shares list performance, with a 5% upper circuit, reflects its competitive dominance. Investors can track peer performance on www.bseindia.com.

6. Should investors hold or sell Siemens Energy India shares post-listing?

The decision to hold or sell Siemens Energy India shares depends on investment goals. Reasons to hold include:

- Growth Potential: 40% EPS CAGR and 24% revenue CAGR projected over FY24–27.

- T&D Boom: Benefits from India’s ₹9.2 lakh crore capex pipeline.

- Analyst Support: Buy ratings from Jefferies (₹3,700), HDFC Securities (₹3,000), and Antique (₹3,179).

Reasons to sell include short-term volatility from MSCI outflows ($170–180 million) and T Group trading constraints. Long-term investors should hold, given the company’s strong fundamentals and market leadership. Short-term traders may consider selling post-circuit to lock in gains but should monitor FTSE index updates. Consult a SEBI-registered financial advisor and check www.nseindia.com for real-time data.

Conclusion

The Siemens Energy shares list at ₹2,840 on June 19, 2025, with a 5% upper circuit at ₹2,982, marks a landmark event for India’s energy sector. As the largest pure-play T&D equipment player, Siemens Energy India is poised to leverage India’s ₹9.2 lakh crore T&D capex pipeline, with a ₹10,050 crore order book and 40% EPS CAGR projected. Despite risks like MSCI outflows, brokerages like Jefferies (₹3,700 target) and Antique (₹3,179 target) are bullish, reflecting strong investor confidence.

The demerger enhances value for Siemens Ltd. shareholders while offering new investors exposure to India’s energy transition. Stay informed via www.nseindia.com or www.siemens.com/in. Share your thoughts in the comments, and subscribe to our newsletter for the latest market updates!