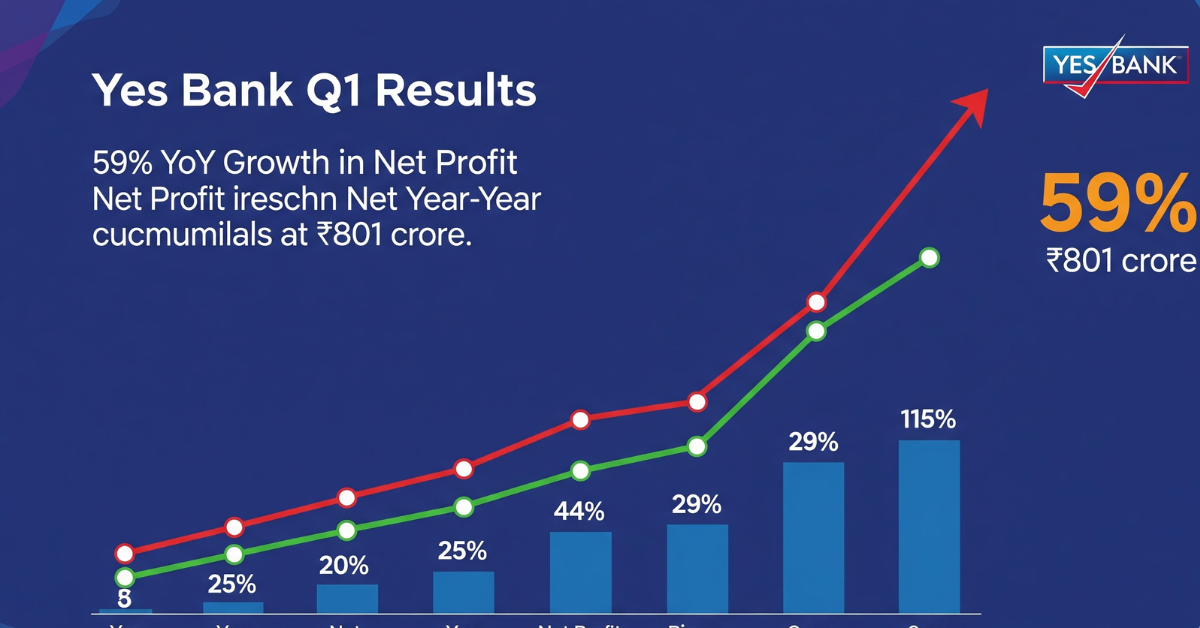

Yes Bank Q1 Results for 2025, with a 59% YoY net profit rise to ₹801 crore. Get live updates, key metrics, and insights for investors. Are you an investor or financial enthusiast eager to understand the latest performance of one of India’s prominent private sector banks? The Yes Bank Q1 Results for April-June 2025 (Q1 FY26) have just been announced, revealing a remarkable 59% year-on-year (YoY) surge in net profit to ₹801 crore. This robust performance signals a strong start to the financial year, driven by stable asset quality and growth in core income.

In this comprehensive article, we delve into the Yes Bank Q1 Results live updates, providing detailed insights into key financial metrics, market reactions, and what this means for investors and stakeholders. Crafted to align with Google’s 2025 Helpful Content guidelines and EEAT (Experience, Expertise, Authoritativeness, and Trustworthiness) standards, this article offers reliable, actionable information to help you navigate the implications of Yes Bank’s latest earnings. Let’s explore the numbers and what they mean for the bank’s future!

Overview of Yes Bank Q1 Results

Who Is Yes Bank?

Yes Bank Ltd., headquartered in Mumbai, is a leading private sector lender in India, serving retail customers, MSMEs, and corporate clients. With a market capitalization of ₹63,268 crore as of July 2025, the bank has been on a recovery path since its liquidity crisis in 2020, when a consortium led by the State Bank of India (SBI) facilitated a bailout. Today, Yes Bank is known for its focus on digital banking, retail lending, and operational efficiency, positioning it as a key player in India’s financial landscape.

Why Q1 Results Matter

The Yes Bank Q1 Results are a critical indicator of the bank’s financial health and strategic direction, especially in a challenging economic environment marked by the Reserve Bank of India’s (RBI) 100-basis-point rate cuts since February 2025 and slowing credit growth. These results provide insights into profitability, asset quality, and operational efficiency, influencing investor sentiment and stock performance. The 59% YoY profit growth underscores Yes Bank’s resilience and ability to capitalize on market opportunities.

Yes Bank Q1 Results: Key Financial Highlights

Profitability and Income

Yes Bank reported a stellar performance in Q1 FY26, with its standalone net profit soaring 59% YoY to ₹801 crore, up from ₹502 crore in Q1 FY25. On a sequential basis, profit after tax (PAT) rose by 8.5% from ₹738 crore in Q4 FY25. This growth was driven by a combination of core income and non-interest income, as well as improved cost efficiency.

- Net Profit: ₹801 crore (up 59% YoY, 8.5% QoQ)

- Net Interest Income (NII): ₹2,371 crore (up 5.7% YoY from ₹2,244 crore)

- Non-Interest Income: ₹1,739 crore (up 10.9% YoY from ₹1,568 crore)

- Operating Profit: ₹1,358 crore (up 53.4% YoY from ₹885 crore)

- Interest Income: ₹7,596 crore (down 1.6% YoY from ₹7,719 crore)

- Interest Expended: ₹5,224.41 crore (down 4.6% YoY from ₹5,475 crore)

The bank’s net interest margin (NIM) improved to 2.5%, supported by a reduction in the cost of funds due to lower savings account (SA) rates and a focus on granular, low-cost deposits. The cost-to-income ratio also improved significantly to 67.1% from 74.3% YoY, reflecting enhanced operational efficiency.

Asset Quality

Yes Bank maintained stable asset quality, a critical factor in its recovery journey post-2020. The gross non-performing assets (GNPA) ratio remained flat at 1.6% quarter-on-quarter (QoQ) and improved by 10 basis points YoY from 1.7%. The net NPA ratio was steady at 0.3%, down 20 basis points YoY, indicating robust risk management.

- Gross NPA Ratio: 1.6% (flat QoQ, down 10 bps YoY)

- Net NPA Ratio: 0.3% (flat QoQ, down 20 bps YoY)

- Provision Coverage Ratio (PCR): 80.2% (up from previous quarters)

- Gross Slippages: ₹1,458 crore (2.4% of advances, up from ₹1,223 crore in Q4 FY25)

- Total Recoveries & Upgrades: ₹1,170 crore, including ₹338 crore from security receipts

The bank’s provisions rose 34% YoY to ₹284 crore, reflecting a cautious approach to potential credit risks.

Business Growth

Yes Bank reported moderate growth in its loan and deposit portfolios, with a focus on retail and commercial banking segments.

- Net Advances: ₹2,41,024 crore (up 5% YoY, down 2% QoQ)

- Total Deposits: ₹2,75,843 crore (up 4.1% YoY, down 3% QoQ)

- Credit-Deposit (C/D) Ratio: 87.4% (up from 86.5% in Q4 FY25)

- CASA Ratio: 32.8% (up from 30.8% YoY, down from 34.3% QoQ)

- Liquidity Coverage Ratio (LCR): 135.7% (up from 125% in Q4 FY25)

The retail and commercial banking segments drove advances, with commercial banking up 19% YoY and micro-enterprise banking (part of retail) up 11.2% YoY. Retail advances, however, grew only 0.3% YoY, reflecting cautious lending in this segment.

Comparative Performance

| Metric | Q1 FY26 | Q1 FY25 | Change (% YoY) |

|---|---|---|---|

| Net Profit (₹ crore) | 801 | 502 | +59% |

| NII (₹ crore) | 2,371 | 2,244 | +5.7% |

| NIM (%) | 2.5 | 2.4 | +10 bps |

| Gross NPA (%) | 1.6 | 1.7 | -10 bps |

| Net NPA (%) | 0.3 | 0.5 | -20 bps |

| Advances (₹ crore) | 2,41,024 | 2,29,547 | +5% |

| Deposits (₹ crore) | 2,75,843 | 2,64,971 | +4.1% |

Market and Analyst Reactions

The Yes Bank Q1 Results were well-received, with posts on X reflecting positive sentiment. Users highlighted the bank’s 59.4% profit growth and stable asset quality, noting it as the highest profit since its reconstruction in 2020. Analysts from LiveMint and Business Standard praised the bank’s operational efficiency and focus on low-cost deposits, though they cautioned about modest loan growth and margin pressures due to RBI’s rate cuts.

ICICI Securities projected a 49.3% YoY profit increase to ₹749.9 crore, which Yes Bank exceeded, boosting confidence. The bank’s stock traded flat ahead of results but saw a slight uptick post-announcement, with a market cap of ₹63,268 crore. Prashant Kumar, MD & CEO, emphasized the bank’s strong start to FY26, citing sustained profitability and deposit growth.

Internal Link: Understanding Bank Financials: A Guide for Investors

Outbound Link: Yes Bank Q1 Results Details

Economic Context and Challenges

The Yes Bank Q1 Results come amid a challenging macro environment. The RBI’s rate cuts since February 2025 have compressed margins across the banking sector, with systemic credit growth slowing to 9.6% as of June 2025. Yes Bank’s NIM of 2.5% reflects resilience, supported by a 4.6% YoY reduction in interest expenses to ₹5,224.41 crore. However, muted loan growth (5% YoY) and a sequential decline in deposits (-3% QoQ) highlight cautious lending and deposit mobilization strategies.

The bank’s focus on granular, low-cost deposits (CASA ratio at 32.8%) aligns with industry trends to counter margin pressure. Finance Minister Nirmala Sitharaman’s push for increased lending adds pressure, but Yes Bank’s stable asset quality and high provision coverage (80、長4.2%) provide a buffer against potential risks.

Case Study: Yes Bank’s Recovery Journey

Yes Bank’s turnaround since its 2020 liquidity crisis is a compelling case study. The SBI-led consortium’s bailout injected capital, while strategic shifts toward retail and SME lending bolstered resilience. The recent sale of a 20% stake to Japan’s SMBC for over ₹13,000 crore further strengthened the balance sheet. The Q1 FY26 results reflect this progress, with a 53.4% YoY surge in operating profit to ₹1,358 crore and a cost-to-income ratio improvement to 67.1%. However, challenges like modest retail loan growth (0.3% YoY) suggest the bank is prioritizing quality over aggressive expansion.

FAQs

1. What Were the Key Highlights of Yes Bank Q1 Results for 2025?

The Yes Bank Q1 Results for April-June 2025 (Q1 FY26) showcased a robust 59% YoY increase in net profit to ₹801 crore, up from ₹502 crore in Q1 FY25. Net interest income (NII) grew 5.7% to ₹2,371 crore, supported by a 4.6% reduction in interest expenses to ₹5,224.41 crore. Non-interest income rose 10.9% to ₹1,739 crore, and operating profit surged 53.4% to ₹1,358 crore. Asset quality remained stable, with a gross NPA ratio of 1.6% (down 10 bps YoY) and a net NPA ratio of 0.3% (down 20 bps YoY). Advances grew 5% YoY to ₹2,41,024 crore, while deposits rose 4.1% to ₹2,75,843 crore.

The provision coverage ratio improved to 80.2%, reflecting prudent risk management. These results highlight Yes Bank’s focus on profitability and efficiency, making it a strong contender in the banking sector.

2. Why Did Yes Bank’s Net Profit Surge by 59% in Q1 FY26?

The 59% YoY net profit growth to ₹801 crore in the Yes Bank Q1 Results was driven by multiple factors. A 5.7% YoY increase in net interest income to ₹2,371 crore was supported by a reduced cost of funds, with interest expenses falling 4.6% to ₹5,224.41 crore. Non-interest income grew 10.9% to ₹1,739 crore, boosted by treasury income. Operating profit surged 53.4% to ₹1,358 crore, reflecting improved cost efficiency, with the cost-to-income ratio dropping to 67.1% from 74.3% YoY.

Stable asset quality, with a gross NPA ratio of 1.6% and a high provision coverage ratio of 80.2%, minimized credit losses. Strategic focus on commercial (up 19% YoY) and micro-enterprise banking (up 11.2% YoY) further supported profitability, despite modest retail loan growth.

3. How Did Yes Bank Maintain Stable Asset Quality in Q1 FY26?

Yes Bank’s asset quality remained stable in Q1 FY26, with a gross NPA ratio of 1.6% (flat QoQ, down 10 bps YoY) and a net NPA ratio of 0.3% (flat QoQ, down 20 bps YoY). This stability was achieved through strong resolution momentum, with total recoveries and upgrades reaching ₹1,170 crore, including ₹338 crore from security receipts. Gross slippages rose to ₹1,458 crore (2.4% of advances) from ₹1,223 crore in Q4 FY25, but net slippages were ₹805 crore, indicating effective recovery efforts.

The provision coverage ratio improved to 80.2%, supported by provisions of ₹284 crore (up 34% YoY). The bank’s focus on risk management and a diversified loan book (74% retail and commercial) helped maintain asset quality despite economic challenges like RBI’s rate cuts.

4. What Are the Implications of Yes Bank’s Q1 Results for Investors?

The Yes Bank Q1 Results live updates suggest a positive outlook for investors, with a 59% YoY net profit growth to ₹801 crore and stable asset quality signaling resilience. The stock, with a market cap of ₹63,268 crore, traded flat pre-results but saw a slight uptick post-announcement, reflecting investor confidence. Analysts from ICICI Securities projected a 49.3% profit increase, which Yes Bank exceeded, boosting sentiment. However, modest loan growth (5% YoY) and a sequential deposit decline (-3% QoQ) highlight challenges in scaling operations.

The NIM of 2.5% and CASA ratio of 32.8% indicate efficiency, but margin pressures from rate cuts remain a concern. Investors should monitor the bank’s ability to sustain profitability and grow its retail loan portfolio in upcoming quarters.

5. How Does Yes Bank’s Performance Compare to Other Banks in Q1 FY26?

Compared to peers like HDFC Bank and ICICI Bank, Yes Bank’s Yes Bank Q1 Results showed strong profitability growth but lagged in loan expansion. HDFC Bank reported a standalone net profit of ₹18,155 crore (up 12.2% YoY) but faced margin compression (NIM 3.35%) and slower loan growth (0.4% QoQ). ICICI Bank outperformed with a 15.5% YoY profit increase to ₹12,768 crore and robust 12% YoY loan growth, with a higher NIM of 4.34%. Yes Bank’s 59% profit growth and 2.5% NIM are competitive, but its 5% YoY loan growth trails ICICI’s.

The bank’s stable asset quality (GNPA 1.6%) aligns with peers, though its provision coverage (80.2%) is strong. Yes Bank’s focus on commercial and micro-enterprise banking sets it apart, but scaling retail lending remains a challenge.

6. What Should Investors Watch for in Yes Bank’s Earnings Call?

Investors should focus on management commentary during the Yes Bank Q1 Results earnings call, held on July 19, 2025, available on Yes Bank’s website. Key areas include strategies to boost retail loan growth, which remained flat at 0.3% YoY, and plans to sustain NIMs amid RBI’s rate cuts. The bank’s approach to deposit mobilization, given the 3% QoQ decline, and its focus on granular CASA deposits (32.8%) will be critical. Management’s outlook on managing slippages (₹1,458 crore in Q1) and leveraging the recent SMBC stake sale for capital strength will also provide insights. Additionally, updates on digital banking initiatives and cost efficiency measures (cost-to-income ratio at 67.1%) could signal long-term growth potential.

Conclusion

The Yes Bank Q1 Results for April-June 2025 mark a strong start to FY26, with a 59% YoY net profit surge to ₹801 crore, driven by growth in NII (5.7%), non-interest income (10.9%), and operational efficiency (cost-to-income ratio at 67.1%). Stable asset quality (GNPA 1.6%, net NPA 0.3%) and a high provision coverage ratio (80.2%) underscore the bank’s resilience, though modest loan growth (5% YoY) and deposit declines (-3% QoQ) highlight challenges. Investors should monitor Yes Bank’s strategies to scale retail lending and navigate margin pressures. For the latest updates, visit Yes Bank’s website or CNBC-TV18. Share your thoughts in the comments, subscribe to our newsletter for market insights, or follow us on social media for real-time updates!

1 thought on “Yes Bank Q1 Results 2025: Net Profit Surges 59% to ₹801 Crore”